It paves the way for long-term sustainability, helping you navigate the complexities of the childcare industry with confidence and success. Feedback and reviews from daycare owners are vital in finding the best daycare billing program. These individuals have hands-on experience with these tools and can provide valuable insights into their performance. Ultimately, creating a separate financial account will lessen your chances of accidentally keeping or reporting wrong business records. Separating your finances will create a clear picture of your business finances and also lessen your chances of triggering an IRS audit.

- For example, if you spend $250 in the current month on classroom supplies, an increase in your expense account, by this amount, is recorded.

- With the increasing number of daycare centers, traditional accounting methods have become time-consuming and prone to errors.

- You can schedule a call whenever you have a question or need advice about the financial health of your daycare business, or you can send a message.

- This program has been a great addition to our small childcare and preschool (around 90 children).

- It empowers businesses to assess the efficacy of their income generation systems, find places where costs could be reduced, and ultimately make sound business decisions.

You can focus on nurturing their future!

We recognize the multifaceted challenges faced by childcare providers, including the demands of daily learning activities and maintaining seamless family communication. However, at Remote Books Online, we firmly advocate for the recognition of sound bookkeeping as the cornerstone upon which your childcare venture can flourish. Accurate financial records serve as a guiding compass, enabling your childcare organization to make informed decisions, allocate resources judiciously, and strategically plan for the future. Beyond financial stability, meticulous bookkeeping ensures unwavering compliance with legal requirements, shielding your organization from potential legal entanglements. While bookkeeping and accounting are sometimes used interchangeably, it’s crucial to distinguish between the two.

- You can start by using a business credit card for all business expenses, creating separate checking accounts, and separating and organizing your personal and business receipts.

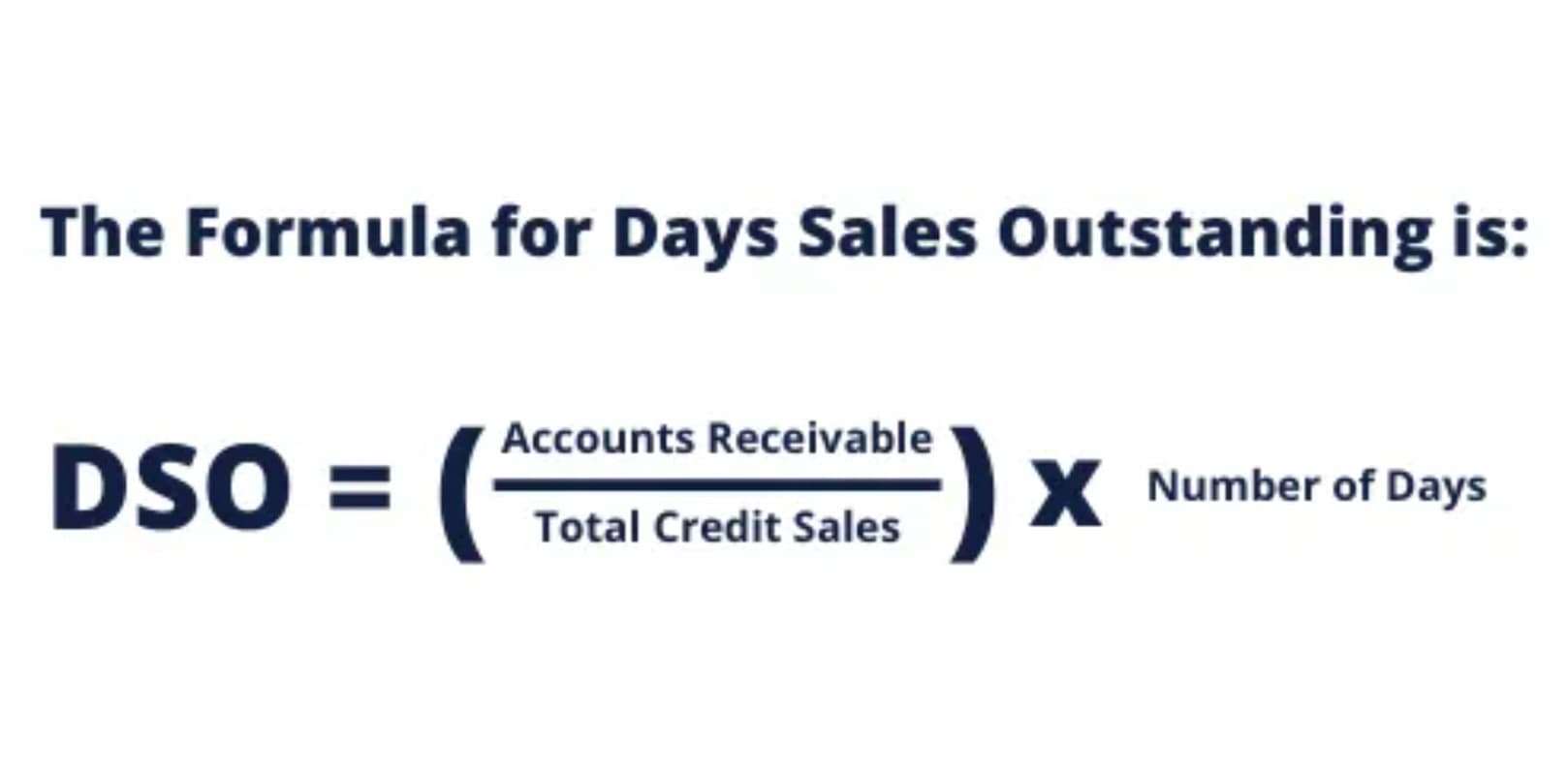

- It keeps track of revenue sources such as tuition fees and other income streams, as well as expenses such as salaries, rent, supplies, and other operating costs.

- This leads to better revenue generation and expense management, two key things to attaining growth.

- By offering detailed quotes and estimates, childcare centers can differentiate themselves from competitors and showcase the value they provide.

Can I track expenses and budgeting with childcare accounting software?

Let’s take a look at some child care billing and accounting features that you cannot afford to overlook. We do this through done-for-you accounting services that streamline your cash flow, remove personal financial stress, and incentivize your staff. Look for a software provider that offers good customer support, such as phone and email support, online resources, and tutorials. This can be especially important if you are new to using the daycare accounting system. The childcare billing software should have a feature for managing suppliers, Medical Billing Process making ordering supplies easy, and tracking delivery dates.

- Be sure to take your time as you move your financial information to any bookkeeping platform.

- With the help of daycare accounting software or a professional accountant, you can generate accurate financial reports so you know where your business stands at all times.

- This can help improve communication and collaboration, which is essential for providing high-quality care for children.

- Categorize expenses to easily identify areas of high spending or potential cost-cutting opportunities.

- It’s important to keep a record of all the payments received from parents, grants or subsidies from the government, and any other sources of income.

- In addition to interacting with complex family situations, there are multiple federal and state agencies that may be involved in your center operations.

Keep Track of Agency Payments for Subsidized Child Care

With 30 years in the industry, we have built a reputation for delivering features that childcare providers love. We equip Shared Service Alliances (SSAs) and Child Care Networks with a powerful financial tool built for their network of childcare providers. Collect tuition, fees, deposits from parents via credit card or bank accounts right after they receive your invoices. Keeping track of receipts, invoices, and financial records can be overwhelming and prone to mistakes. A well-organized bookkeeping system is key to keeping your finances in order and reducing your stress. Since 2004, Jackrabbit has served thousands of owners, directors, administrators, educators, and parents.

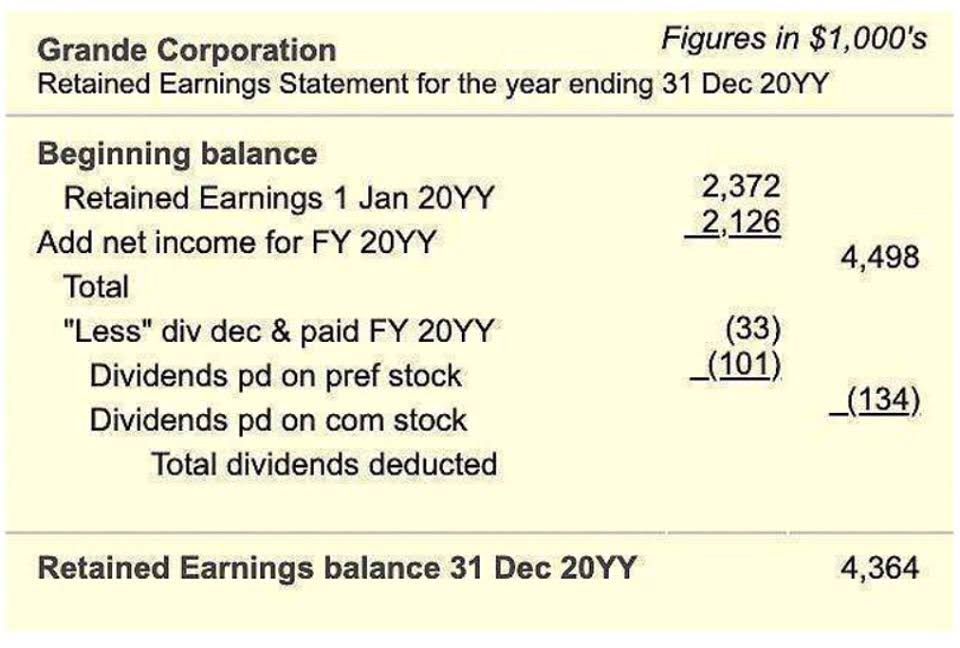

If you are sick of wasting hours upon hours looking at spreadsheets, it’s time to go searching for the answer to your accounting woes. Easily track income and expenses, send professional invoices, and accept online payments—without stretching your budget. The essence of a profit and loss statement (P&L) template is its capacity to provide a comprehensive and analytical view of a daycare business’s financial dynamics over a specified period. This template, by methodically analyzing the delicate threads of financial operations, serves as a critical tool for daycare organizations, providing them with a panoramic view of their economic strength.

This proactive examination of alternative revenue streams not only reinforces the foundation of financial security but also instills a spirit of creativity and expansion in the organization. Why struggle to do it alone when you can rely on a seasoned professional in your industry to guide you and relieve you of that burden? When you become a client, you instantly gain access to our platform and both of our mobile applications to make sure your contra asset account business is running as smoothly as possible. Generate detailed performance and development reports to understand the children’s progress in your childcare centre. Streamline and improve communications by sharing all the daily activities and updates through a real-time, easy-to-use, and secure mobile application accessible anywhere.

Accounting & Time/Space

Fortunately, most of the documentation you need to give the government—financial transactions, statements, and cash flow reports—is easily accessible when you stay up to date with your bookkeeping. Daycare bookkeeping involves tracking and recording all your expenses and income for your childcare business. Learn why you need an organized system to maintain the financial health of your business. Parachute is designed to empower your business and allows you to stay on top of your childcare business finances and performance. It allows you to send invoices easily, accept payments from parents and provides you daycare accounting all of the necessary tools, and tax reports for your business. It has never been easier to collect tuition, fees, deposits from parents via credit card or bank accounts right after they receive their invoices.